The MyGreatLakes login site is one of the most useful tools for students because it helps them understand how to handle the complicated world of student loans. Applying for student loans, handling them, and paying them back are all easier because they are all in one place.

Many helpful tools are available to students to help them better handle their school finances. These tools include thorough loan information and a variety of ways to pay back loans.

Users can consolidate their loans, set up automatic payments, and see their different payback plan choices through the MyGreatLakes login portal. In addition, it makes it easy for users to keep track of payments and see recent bills. In addition to giving help through customer service, it also makes sure that strong security measures for personal information are in place.

With an easy-to-use layout, the site helps students learn how to properly handle their loans by providing tools to improve their finances and finding out about loan repayment programs.

| Official Name | Purpose | Users | Country | Portal Language |

|---|---|---|---|---|

| MyGreatLakes | Simplifying the loan repayment | Students | United States | English |

Contents

- 1 Understanding MyGreatLakes Login

- 2 How to Register at MyGreatLakes login?

- 3 Great Lakes Login Procedures

- 4 MyGreatLakes Student Loan Account Access Essentials

- 5 Important MyGreatLakes Student Loan Management System Features

- 6 Using Great Lakes Login Benefits

- 7 Managing Your Student Loan Payments Online

- 8 MyGreatLakes Common Inquiries

- 9 Conclusive

Understanding MyGreatLakes Login

MyGreatLakes Login is a comprehensive online platform designed for borrowers to manage their student loans effectively. This login portal serves as a central hub for users seeking details on their educational loans, offering an array of features including:

- Loan Information: Up-to-the-minute loan balance and detailed history.

- Payment Tracking: Record of past payments to monitor loan progression.

- Customizable Solutions: Range of payment plans to fit individual financial situations.

- Tools for Financial Planning: Repayment estimators and budgeting calculators.

- Automated Payments: Convenience to setup and forget recurring payments.

- Credit Insights: Access to credit reports to gauge financial standing.

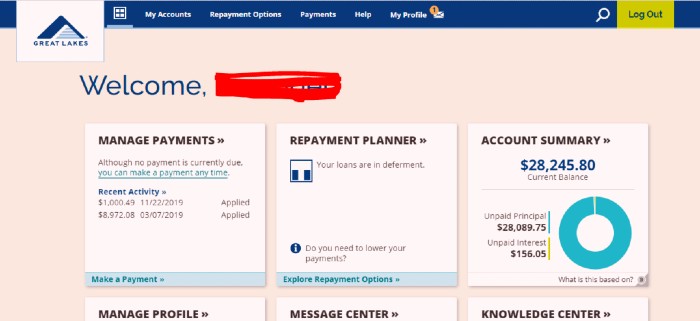

MyGreatLakes basically gives borrowers an easy-to-use dashboard to make loan handling easier. This makes sure that borrowers can quickly and safely get to important information about their college finances.

This is in line with the goals of the Department of Education to help students with the payback process and promotes good federal student loan money management.

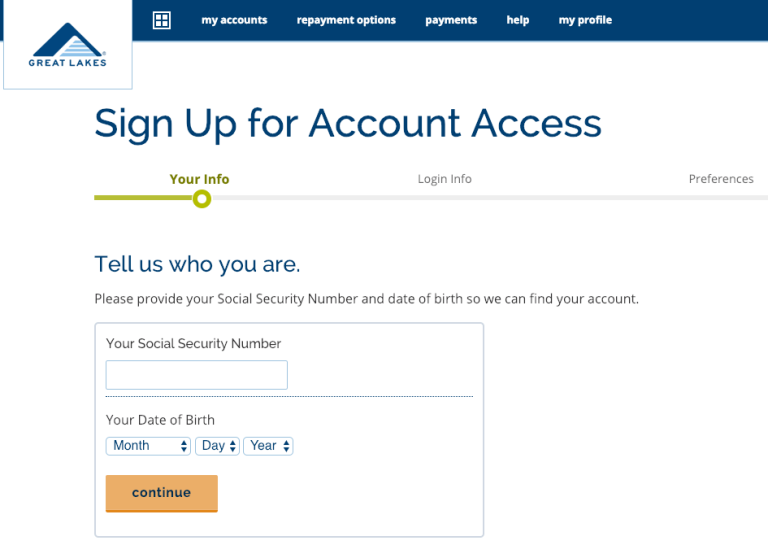

How to Register at MyGreatLakes login?

Accessing your student loans can be easier if you create an account with Great Lakes. There is a central place for loan applications, payments, and keeping track of loan information on their easy-to-use online website.

The registration process is straightforward:

- Go to the home page for the Great Lakes student loans login.

- Choose the “Register” choice that stands out at the top.

- You need to enter your full name, address, and Social Security number.

- Set up a unique nickname and a strong password to get into your account.

- To make your account safer, answer a set of security questions.

- Click “I agree” to read and follow the rules.

- To finish the signup, click the “Submit” button to finish the process.

It’s easy to log in to the MyGreatLakes membership site after signing up. The tool is meant to make it easier to apply for loans, keep track of loan balances, see payment records, change contact information, and do a lot more. You can set up automatic payments to make sure that your monthly payments are always made on time and without any problems.

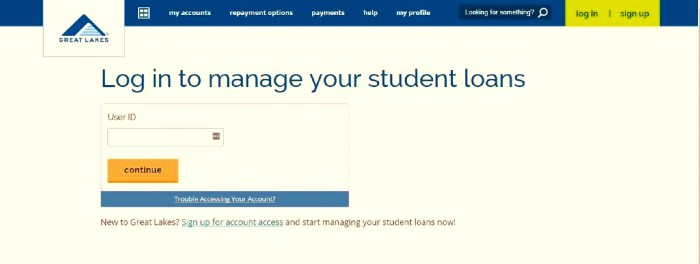

Great Lakes Login Procedures

Great Lakes login is an easy-to-use online tool that supports users who need to manage their student loan accounts. By entering into the MyGreatLakes portal, users can easily keep track of their payments and keep their accounts in good standing.

To access your loan information via MyGreatLakes, the following steps should be employed:

- Go to the website for the Great Lakes student loan login.

- Type in your current User ID and password. If you haven’t already, click “Register Now” to make a User ID.

- To make a User ID and a password, just follow the steps given.

- After signing up, you’ll need to enter your User ID and Password again on the login page to get into the site.

- You can look over the details of your loan, see what payments you’ve already made, and see what payments are coming up in the site.

Additional functionalities after signing in include:

- Making payments: This can be done directly within the portal.

- Activating paperless billing: Opt-in to receive statements electronically.

- Enrolling in automatic payments: Set up a schedule for payments to occur automatically.

These options enhance the simplicity of keeping loan accounts current. Should borrowers encounter any difficulties with their accounts, it is possible to seek further assistance through troubleshooting resources.

MyGreatLakes Student Loan Account Access Essentials

Establishing an Active Account

To manage your student loan account online through Great Lakes, an active loan account is imperative. It is the gateway to viewing your loan balance, exploring repayment plans, and keeping track of your payments.

- Online Account: Once your loan account is active, you have the privilege of utilizing the versatile features offered by the online portal.

Generating a Secure Login

Securing access to your loan details requires two key components:

- Username: Your email address serves as the username, a necessity for all loan-related communications and portal access.

- Password Creation: A strong password is critical for securing your account. It should include a minimum of eight characters, with a mix of upper and lower case letters, as well as digits.

| Requirements | Criteria |

|---|---|

| Length | At least 8 characters |

| Complexity | Mix of uppercase, lowercase letters and numbers |

Verifying Personal Information

Verification of your identity is a crucial step to maintain the exclusivity and security of your loan account. Ensure you provide accurate personal details:

- Identification: Basic personal information such as full name and date of birth.

- Social Security Number: For identity verification and security purposes.

- Address: Confirm your current residence for account accuracy.

| Personal Details | Purpose |

|---|---|

| Social Security No. | Identity verification and account security |

| Full Name & DOB | User authentication |

| Address | Ensuring account correspondence accuracy |

Important MyGreatLakes Student Loan Management System Features

Loan Merging Capabilities

This system permits borrowers to merge numerous student loans into a single loan. This streamlines the repayment process, potentially reduces interest costs, and simplifies the management with a solitary monthly installment.

Efficiency in Electronic Payments

The Great Lakes platform enhances payment efficiency by enabling secure online transactions. Borrowers have the option to arrange automatic debits to ensure timely payments and avoid the hassle of remembering due dates.

Diversity of Repayment Strategies

The portal extends a variety of repayment strategies tailored to fit diverse financial circumstances and objectives. Borrowers may opt for plans including standard 10-year repayment, extended repayment stretching over 25 years, a graduated plan with incremental payment increments, or income-driven repayment plans adjusted to their income levels.

Accessibility of Account Statements

Loan account statements are readily accessible through the system, allowing users to monitor and verify the current status and history of their loan repayments. Regular access ensures that borrowers remain informed about their loan status and payment schedules.

Support and Assistance

Great Lakes assures extensive support and assistance is continually available to borrowers, day or night. User inquiries and concerns about their loans are addressed professionally and with the utmost care by dedicated customer service representatives.

Using Great Lakes Login Benefits

Convenience:

Users can experience the ease of handling student loan tasks with the online management platform. Available round-the-clock, borrowers have the ability to check balances, make payments, enroll in autopay, and opt for paperless communication.

Automated Payments:

The platform offers a system for automatic payments from a linked bank account, giving borrowers peace of mind knowing their monthly payments are punctually handled.

Loan Details:

Borrowers are provided with comprehensive insights into their loans, such as outstanding balances, interest specifics, and repayment schedules, aiding in financial planning and strategy.

Loan Repayment Options:

A suite of flexible repayment strategies is on offer to accommodate varying financial circumstances, including income-based arrangements and plans that progressively or extend over time.

Forgiveness Programs:

Eligibility for loan forgiveness initiatives is a critical service provided, potentially allowing for a reduction or full discharge of student debt for qualified borrowers.

Customer Support:

The platform guarantees continual support to assist borrowers with any inquiries or challenges they may face, ensuring ongoing guidance for effective loan management.

Loan Consolidation:

For those juggling multiple student loans, a consolidation service is available to simplify payments into one monthly bill, potentially lowering interest rates and simplifying financial tracking.

Security:

Cutting-edge security measures safeguard personal and financial data, employing robust encryption and multi-factor authentication to ensure protection against unauthorized access.

Credit Score Monitoring:

The system encourages responsible financial behavior by allowing borrowers to monitor how their credit score is influenced by timely loan payments and overall credit activity.

Financial Resources:

A wealth of educational tools are at borrowers’ disposal, offering articles, instructional videos, and other resources designed to enhance their financial literacy and promote savvy financial decision-making.

Managing Your Student Loan Payments Online

Accessing Your Online Account

Individuals should initiate the payment process by signing into their online dashboard established on the loan servicer’s website. For those without an account, one can easily be set up by providing necessary personal details.

After logging in, users should locate and select the option to transfer funds. This action redirects them to the payment interface where various payment methods, such as debit or credit cards and bank transfers, are available.

Selecting Payment Preferences

Within the payment interface, borrowers have the opportunity to indicate their desired payment structure. Options typically include single-instance or recurring transfers, and users must specify the amount and scheduled date for the payment.

Verifying and Submitting Payment

The final step requires a thorough review of the payment details entered. Once confirmed accurate, the submission will finalize the payment process.

MyGreatLakes Common Inquiries

Nationwide Availability of Loan Services

Loans through Great Lakes are accessible to borrowers across the entire United States, offering financial solutions for higher education to both students and their guardians.

Assistance Available Through the Online Platform

The Great Lakes portal provides users with an array of supporting tools which include budget planning, repayment estimations, direct access to loan specialists, and informative content to aid in financial management.

Steps for Submitting Payments Using the Online System

Payments can be processed with ease on the portal by utilizing options such as:

- Direct bank transfers (ACH)

- Debit card transactions

- Credit card payments

Online Payment Process Fees

Users are not charged any fees when completing online payments, ensuring a cost-effective method for managing loan repayments via the Great Lakes platform.

Additional Advantages of Utilizing the Great Lakes Online Portal

By using the online portal, borrowers gain several advantages:

- Set up autopay for effortless, timely payments

- Track your loan balance and payment history

- Enjoy the convenience of managing loans efficiently and remotely

Conclusive

The MyGreatLakes online site can help students who are having a hard time paying back their student debts. Because everything is in one place, this centralized layout makes managing loans easier and faster, letting users see and pay off their bills quickly.

Notably, the partnership with Nelnet, another government loan servicer, shows how strong the services are. For more help or questions, the online contact information makes sure that users can get in touch with the helpful community for support and advice.

The site is a big step toward making it easier for students to pay back their loans, which will help them get through their financial troubles.